by: Douglas K. Fryett – Fryett Consulting Group & Keith Warren – Foodservice Equipment Association

Supply chain management is all about managing something that is rather “static” in nature. By simple definition, it is about “managing” an existing model designed to provide a certain degree of “value” to all channel participants that are part of a particular supply chain. That value has to have a degree of financial worth on a company’s balance sheet.

Foodservice equipment and supply manufacturers have their upstream vendors who are supplying the various raw materials and components necessary to manufacture and assemble their particular family of products. These manufacturers, in turn, have their down-stream channel partners as well – equipment and supply dealers, food distributors, design consultants, and service agencies – who are “responsible” for providing an “efficient” go-to-market strategy for manufacturers. Unfortunately, most participants in a supply chain only consider what is happening at their point in the chain.

Value chain strategy takes on an entirely different complexion. By nature, “value” is very dynamic — it is constantly changing – as value is always in the eyes of the beholder. In other words, it means different things to different people, or constituent groups, and at different times. As such it requires a significantly greater degree of nimbleness, cooperation between all of the various value channel constituents, and attention being paid to it by all members of the value chain.

Supply Chain Strategy or Value Chain Strategy?

It will be important that organizations shift to a value chain strategy business model from the more traditional supply chain management model. Why? Because this will allow them to optimize their economic and brand position within the marketplace. Simply stated, if you are not providing value, no matter where you are positioned within the chain, you will eventually become irrelevant. And once you become irrelevant it is only time before you will become obsolete. To put it another way, to achieve sustained growth, companies should be concentrating their strategic and tactical efforts on developing and executing strategies that create defined value for all of the various channel constituents within their supply chain rather than focusing on trying to develop that rather elusive sustainable competitive advantage. Because in today’s marketplace such a thing – sustainable competitive advantage – very rarely exists.

Putting it in the context of the foodservice industry, the biggest challenge facing today’s foodservice equipment industry leaders is finding new and innovative ways to create and sustain value for the end-user / operator base.

Look at Your Market

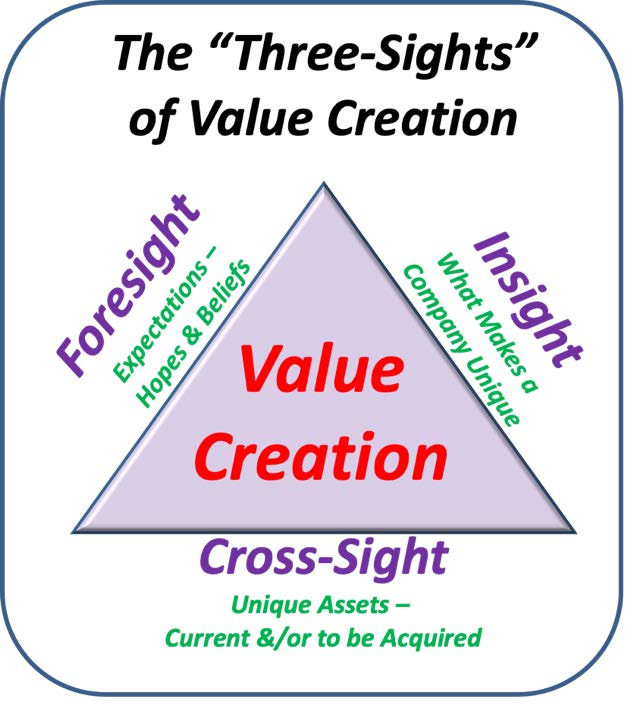

But how can a company create sustainable “value” for its constituents? How can it make value creation one of its corporate values and institutionalize it? Todd Zinger, in a Harvard Business review article, proposes that value can be created through the convergence of three “sights” – foresight, insight, and cross-sight. Let’s take a closer look at these “sights” that he has identified and relate them to the foodservice industry.

Foresight should clearly articulate a company’s expectations and beliefs regarding the short and long-term future of the foodservice industry. It should clearly predict future consumer tastes and/or consumer demand; operator issues and drivers; take into consideration the use of current technologies and the emergence of new technologies. It should also anticipate the reaction of its competitive rivals. Foresight also suggests those asset acquisitions, investments, and strategic actions and alliances that will prove essential in a company’s predicted future state of the foodservice industry.

Foresight should clearly articulate a company’s expectations and beliefs regarding the short and long-term future of the foodservice industry. It should clearly predict future consumer tastes and/or consumer demand; operator issues and drivers; take into consideration the use of current technologies and the emergence of new technologies. It should also anticipate the reaction of its competitive rivals. Foresight also suggests those asset acquisitions, investments, and strategic actions and alliances that will prove essential in a company’s predicted future state of the foodservice industry.

Today, there is a massive convergence of industry and non-industry dynamics – new technologies; the increased proliferation of existing technologies; sustainability and all of the “peripherals” associated with sustainability; the increased use of analytics-based management; the growing use of Artificial Intelligence (AI), the Internet of Things (IoT), changing consumer “demands,” changing end-user / operator dynamics, to name but a few that are, and will continue to shape the global foodservice industry.

Insight is what makes a company unique. If your competitors have assets and capabilities that are very similar in nature to yours, then they can certainly replicate and execute your strategy, or more disturbing, even improve on it. True insight is very company-specific – it identifies those assets that are the unique selling propositions and which are distinctive, and valuable to your company and to your customers. i.e. your brand values. They are assets that companies can, and should, highly leverage in the marketplace. Some might refer to this as having a core competency, but it is much bigger and broader than this.

Cross-Sight is a company’s ability to identify those assets that are uniquely valuable to a company and/or an asset with unique value that other companies are simply unable to attain or replicate. These can be aggressively deployed by your organization as being your core values. Think of Apple Computer and the numerous technology acquisitions and product developments that it has made over the years that have made Apple products leaders within the consumer electronics field.

Foresight, insight and cross-sight, when combined and used together, will allow companies to create a continuous succession of value-creating strategies. Foresight, specifically as it applies to future demand, the use of new and existing technologies, and industry and consumer trends, will highlight those areas in which companies should be searching for cross-sight, to meet those needs. Conversely, insight, regarding a company’s unique assets, will help focus a company’s integration of both foresight and cross-sight. Finally, cross-sight will help reveal those valuable complementary products and services, which in turn will highlight the domain of foresight.

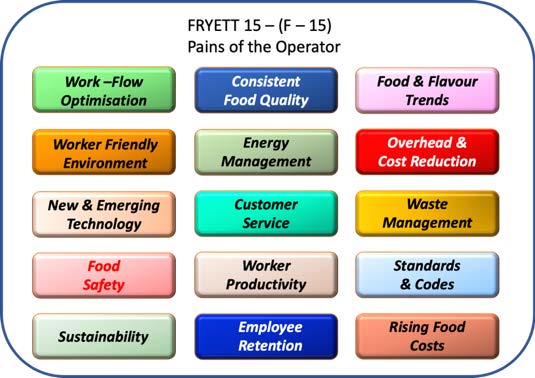

Value creation for foodservice industry end-users / operators should focus squarely on their experiences and solutions to their problems, their “pains.” Study after study in this industry has shown that what operators are looking for from their up-stream channel constituents. Companies that engage and provide the best solutions to their problem will maintain a ‘value-added’ relationship. As with all relationships, this too has to be continually developed. A recently published article classified a whole host of operator issues into fifteen key “pains” – the Fryett 15 (F-15). Helping operators solve these pains should certainly be a key goal and driver for all of the constituents within the foodservice industry channel.

Creating value helps negate the pricing factor that is so often associated with “selling” products and not with solving the operators’ problems. Operators are always trying to “increase” or “decrease” something – in one or more of the F – 15 pains. To state it slightly differently, they are charged with the responsibility to improve on these identified pains; to understand the associated value of those improvements, or the consequences associated with a lack of improvements.

If you do this through the use of the “Sights” Model you will create true and sustainable value for your customers. This should include all aspects of your business: pre-sales, the product itself, your staff, logistics, after-sales support, and brand heritage, to name but a few.

Companies who do an excellent job of integrating customer needs into their products or services put themselves inside their customers’ businesses (in some cases, literally). They can then embrace the outcomes that they (their customers) are trying to achieve. The great Austrian born management guru, Peter Drucker, noted that knowledge-driven innovations are “almost never based on one factor but rather on the convergence of several different kinds of knowledge.” The initial knowledge that is “born” often results in a tremendous amount of activity and excitement, but it is not until all pieces of the knowledge puzzle have been “discovered” and put into their appropriate places that true progress can actually be achieved.

External Forces and Drivers – the Data Revolution

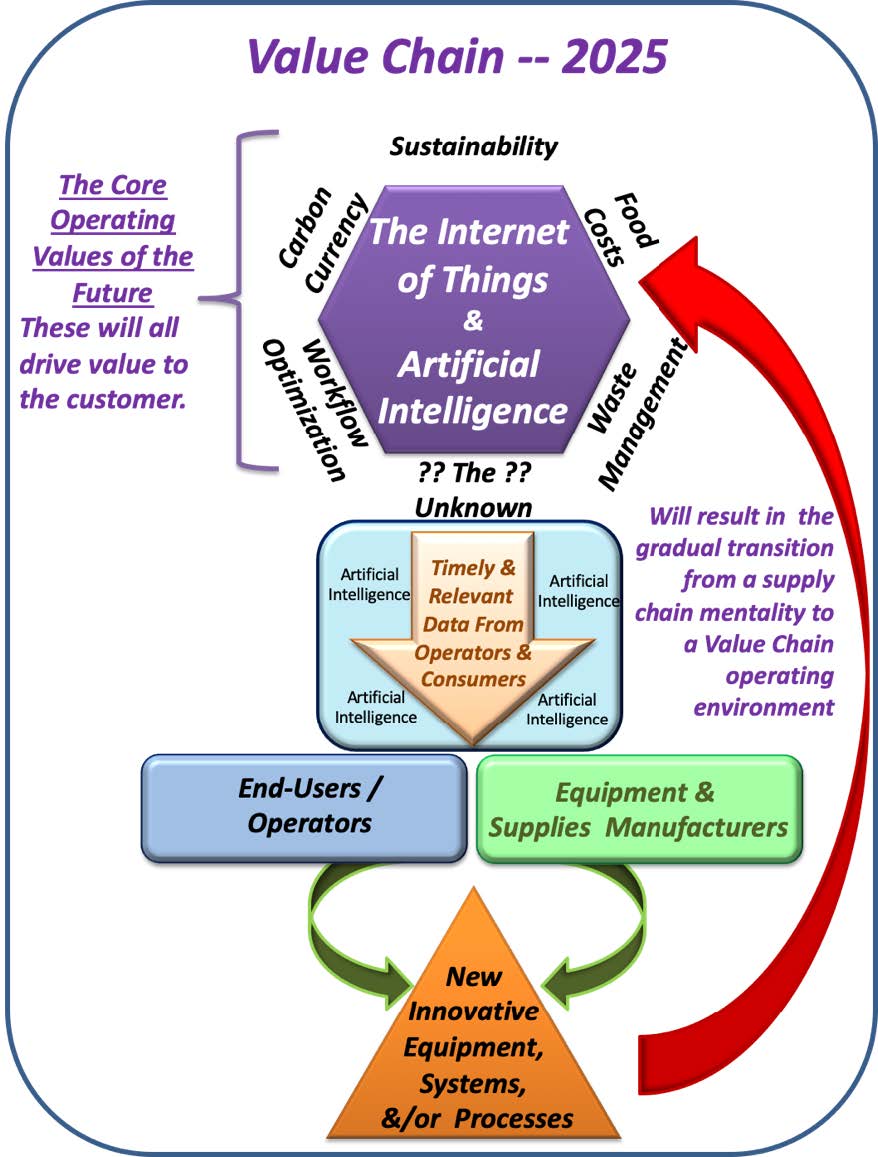

The “internet of things” (IoT), “big data,” and “artificial intelligence” (AI) and the Circular Economy are widely acknowledged to be the drivers of the move to a value chain strategy. (This is already happening at the consumer/operator interface within the foodservice and many other industries.) They will become the hub of technological developments for the foodservice industry. Ultimately, the ability, and willingness, to share and integrate data amongst all constituent groups will lead to foodservice equipment that is intuitive to use, operationally efficient, resource-efficient, staff efficient and which ensures effective functionality within the foodservice, system, thus making it even more important to operators. Of course, data is the common link that will need to be reported in a common structure and common format across all constituent groups.

In fact, the data revolution and artificial intelligence that society is in the midst of today is the contemporary equivalent to the industrial revolution of the mid-18th century. Those who adopt will significantly increase their chances of survival. Those who don’t, well …

Another way of looking at it is that the combination of data and artificial intelligence is an organization’s new capital. Like any form of capital, it has to be managed effectively in order to garner the greatest return — Return on Artificial Intelligence (RoAI). As AI spreads further into the foodservice industry as a program, when coupled with large amounts of data, it will be able to make predictions that will help guide all channel constituents in making better and more informed decisions.

Data management analysis teams and AI “managers” will be as essential to a business in the year 2025 as marketing, sales, accounts, and operations teams are today. We are seeing this start through Building Information Modeling (BIM) which allows cloud-based design using 3 dimensional rendered models to which data is tagged. This has already started to be a requirement in public sector projects in a growing number of countries throughout the world. By more efficient collaboration between the designer and contractors, BIM has been found to reduce procurement costs by 20% and more. Having a full inventory of the equipment in the building, the day to day operation and performance will be managed including, the kitchen. The direct product profitability of the equipment will be continually evaluated and managed to ensure that it is contributing to the operator’s profits. This will also assist with the management of food costs and the management of food waste in an effort to contain overall costs.

The equipment companies that are closest to the foodservice operator will have the opportunity to gather, and through the use of AI, interpret data on the activity in sites and with the consumer. Thus, the benefits of “big data,” the “internet of things” and “artificial intelligence” will inevitably grow. Manufacturers in the “new” value chain will have specialists within their own business who can interpret, use the data, and turn it into valuable, actionable information. This will provide a competitive advantage at all levels in the chain but especially with the foodservice operator’s management team. This interdependence will provide a greater understanding of operator and consumer habits, and link this to the equipment’s operational needs. The use of data in this way will increase the need for transparency and trust between the equipment manufacturers and the foodservice operators.

The equipment companies that facilitate and support the generation of this data, combined with the commitment to interrogate it effectively, will have the edge over their competitors. They will also have the opportunity to develop new equipment and services based on detailed knowledge from the marketplace; this equipment “black box” of information will include utilities use, patterns of use, optimum labor requirements and so on, to name but a few. With all of this management information available it will get to the point where the net profitability of a menu item will be driven by the information on the equipment used to prepare it; the utilities used in its preparation and service; the consumables used, and the labor required. A net-zero carbon future is now reality for business and consumers alike. Carbon will be the currency of the future, the use of data in this way can provide a carbon footprint for the equipment, the kitchen, and the menu. The availability and use of data in the proposed new value chain will mean that equipment companies will have the opportunity to develop new products which will subsequently provide access to even more data, which they will need to help turn into actionable information. This, when linked to the identification and transfer of innovative ideas and technologies from other industries, will complement a company’s own research and development initiatives.

There is a profitable and rewarding outlook for those companies who can sustain their strategies with ever closer engagement with specifiers and foodservice operators. There will be the inevitable and unforeseen disruptive influences on business (as there always has been) but an enhanced value proposition that is data-focused and driven by artificial intelligence, will be key to effective business development. There will be greater opportunity to embrace the disruptions productively when companies are engaged with day-to-day operational realism. It will even allow companies with the foresight to be the disruptors themselves.

A key issue that must be addressed is the need for the value chain to have an outlook that allows the market to group for all participants. Data will be the key driver for this, but it is essential that companies have the ability to know where they can work together for the benefit of the whole sector. Data is a tradeable commodity, but it needs to be exchanged on a common framework of reporting and interpretation. A mutually agreed and implemented framework of reporting will add value to all in the value chain without compromising the commercial development of products or services. Data used in this way has the ability to provide menu ‘farm-to-fork’ carbon cost analysis.

Engage and Evolve

In summary, the transition from a supply chain to the value chain will and can only be achieved by those companies that show the ability to engage and evolve their management thinking and practices. Companies that are able to demonstrate the ability to flex their resources and actively engage all of their channel constituents in a meaningful and transparent way will become part of the value chain that is already beginning to evolve.

The Inter-Governmental Panel on Climate Change (IPCC – the United Nations’ body for assessing the science related to climate change) has identified 17 Sustainable Development Goals. 11 of the 17 are directly related to the foodservice industry. The use of data will allow for the integration of the developments that will significantly assist with their achievement. How often is it said that companies and individuals cannot make a difference in reducing the effects of climate change because the problem is too big? Well, that moment has passed as governments set laws or publish targets for net-zero carbon by 2030-2050. We will see the decentralization, decarbonization and digitalization of energy supply networks, greater controls on the design and performance of equipment; a change in the diet of consumers, less water being used and the minimization of food waste. The 17th goal is about developing partnerships for the goals – data will be a key element of the partnerships. One can’t manage what one can’t measure!

These are but a few of the changes, some of which we are seeing today. Data & artificial intelligence provide the common threads to make all of this change deliverable through measured evaluation and its place in our connected cities and connected lives.

Click here to download this in PDF form.

About the authors:

Douglas K. Fryett is the founder of the Fryett Consulting Group a global consulting firm specializing in strategy development, strategy execution, and proprietary market research for companies and organizations in the hospitality/foodservice industries. He is also a frequent speaker at industry conferences and events.

Keith Warren is the chair of the EFCEM (European Federation of Catering Equipment Manufacturers) marketing, BIM, and Connectivity committees. And is the Chief executive of the Foodservice Equipment Association, the leading UK industry trade association. Keith has also taken on major leadership roles in various catering associations throughout Europe.

Keith and Doug are viewed as key thought leaders within the global foodservice industry.